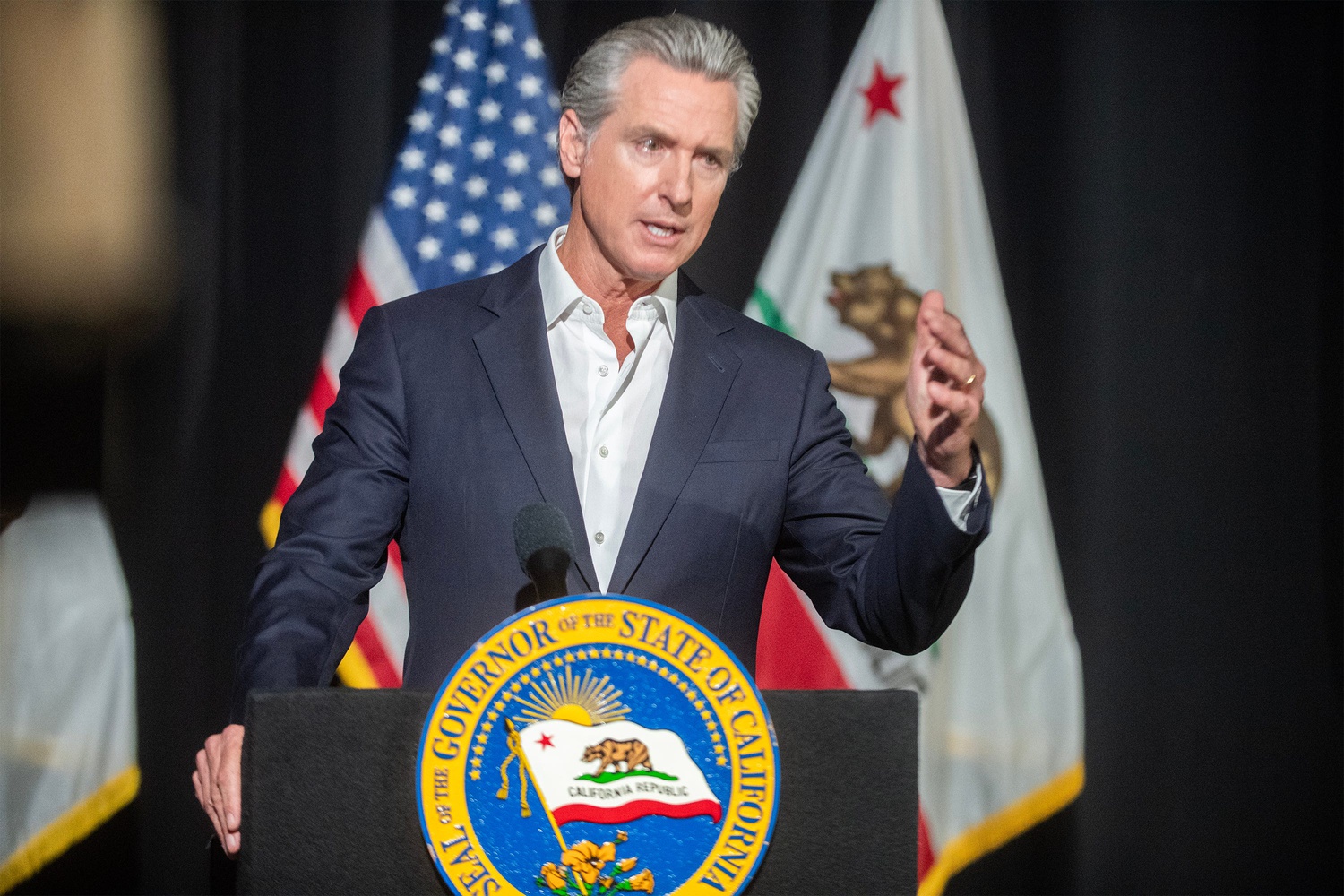

2028 Democratic Nominee For President Odds: Gavin Newsom In Front

Featured Image Credit: CLIFFORD OTO/THE STOCKTON RECORD / USA TODAY NETWORK via Imagn Images

Here are the current odds for the Democratic Nominee for the President in 2028:

Presidential election odds for 2028 feels so far away, but the presidential election will be here before we know it. The Democratic party needs to choose who they are going to nominate to battle the MAGA movement.

Prediction markets like Kalshi offer odds for the next Democratic Nominee for President. Below, we will dive into the latest odds.

Here's everything you need to know about 2028 democratic nominee for president odds, ahead of the 2028 presidential election: action, line movement and betting trends, with insights from prediction markets and the current odds. Check out the best prediction market apps to buy and sell contracts on who will be the next Democratic Nominee for President.

Democratic Nominee For President Odds

The Democratic party is faced with a tall task, saving face after the 2024 democratic nominee debacle where Joe Biden dropped out and was replaced with Kamala Harris as the democratic nominee. This sudden change left members of the democratic party upset with the process and critical of their own party. It is important they get this one right.

Gavin Newsom is the current favorite. Newsom has been making his media rounds, doing appearances on Stephen Colbert, All The Smoke, as well as starting his own show, "This Is Gavin Newsom". Newsom is attempting a moderate democratic approach, encouraging collaboration across party lines.

Alexandria Ocasio-Cortez is also in the running, and appeals to the younger generation with her focus on affordability. Her approach to social media is appealing to young voters, as she has a history of going live on Twitch with then VP-nominee Tim Walz to play Madden. AOC has also streamed herself playing "Among Us" while chatting with viewers.

Other names have been making media appearances, such as Pete Buttigieg and Kamala Harris, potentially pointing to a presidential campaign.

Here are the current odds for the Presidential Democratic Nominee:

How Does This Prediction Market Work?

Prediction markets are online platforms where people trade shares on the outcome of real-life events. In this case, it is who the Democratic Nominee for President will be in 2028.

How They Actually Work – Step by Step

- An event is created with clear resolution rules Example: “Will Kamala Harris be the Democratic nominee in 2028?” Resolution source is usually unambiguous. In the case for this particular market on Kalshi, the outcome will be verified by the Democratic Party.

- Two (or more) contracts are issued

- “Yes” shares

- “No” shares (For multi-outcome events there can be many: Trump, Harris, Newsom, Vance, etc.)

- You buy shares in the outcome you think will happen

- If a “Yes” share costs 32¢, the market is saying there is a 32% chance it happens.

- If a “No” share costs 68¢ → 68% chance it doesn’t happen.

- Prices move with buying and selling

- If new information comes out that makes “Yes” more likely, people buy “Yes” shares → price rises (e.g., from 32¢ → 58¢).

- “No” shares automatically fall because Yes + No always = $1.00.

- At expiration

- If the event happens → “Yes” shares pay $1 each, “No” shares pay $0.

- If it doesn’t happen → “Yes” = $0, “No” = $1. You can sell your shares anytime before expiration to lock in profit/loss.

Simple Profit/Loss Example

You buy 1,000 “Yes” shares at 25¢ each → cost = $250 Later the price rises to 75¢ because new polls look good.

You have two choices:

- Sell now: 1,000 × $0.75 = $750 → $500 profit

- Hold until expiration:

- If Yes wins → 1,000 × $1 = $1,000 → $750 profit

- If No wins → 1,000 × $0 = $0 → –$250 loss

Why Prediction Markets Are Often More Accurate Than Polls

- Real money on the line: people research and think hard

- Immediate feedback: prices adjust instantly to new info

- Incentives align: you profit by being right and early

- Marginal trader effect: the people with the best information or models tend to dominate the price

Studies (Iowa Electronic Markets since 1988, PredictIt, Polymarket 2024 election) repeatedly show they beat polls, pundits, and experts, especially close to the event.

Risks & Caveats

- Liquidity can be low on niche questions means big swings.

- You can lose 100% of money invested on a contract

In short: Prediction markets turn beliefs into dollar amounts, aggregate information through trading, and pay people for being right. The current price is the crowd’s best guess of the probability, and it’s often accurate.

Featured News

-

FEATURED JAN 25, 2026

FEATURED JAN 25, 2026NFL Conference Championship Game Odds: Lines, Spreads, Betting Trends for Both Matchups

-

FEATURED JAN 25, 2026

FEATURED JAN 25, 2026Best NFL Parlay Picks Today

-

FEATURED JAN 20, 2026

FEATURED JAN 20, 2026NFL Conference Championship: Los Angeles Rams vs. Seattle Seahawks Prediction, Odds, Preview

-

FEATURED JAN 25, 2026

FEATURED JAN 25, 20262026 Super Bowl Odds: Lines, Spreads, Betting Trends for NFL Championship Game

-

FEATURED JAN 23, 2026

FEATURED JAN 23, 2026PGA Tour Majors Best Ball: Your Guide To Underdog’s “The Albatross” 2026

-

FEATURED JAN 21, 2026

FEATURED JAN 21, 2026Who Will be on the Cover of MLB The Show 26? MLB The Show Cover Odds